How To Open A Bitcoin Account

This page is dedicated to you on How To Open A Bitcoin Account. Follow the steps provided on this page to improve your techniques on How To Open A Bitcoin Account.

Steps on How To Open A Bitcoin Account

There are several ways you can buy Bitcoin.

- Use a Bitcoin Exchange

- Discover people selling Bitcoin in your community

- Use a Bitcoin ATM

First, Sign Up for a Bitcoin Wallet

Before you buy Bitcoin, you need to download a Bitcoin wallet by going to a site like Blockchain.info, or to a mobile app such as Bitcoin Wallet for Android or Blockchain Bitcoin Wallet for iOS, and filling out an online form with basic details. This shouldn’t take more than two minutes.

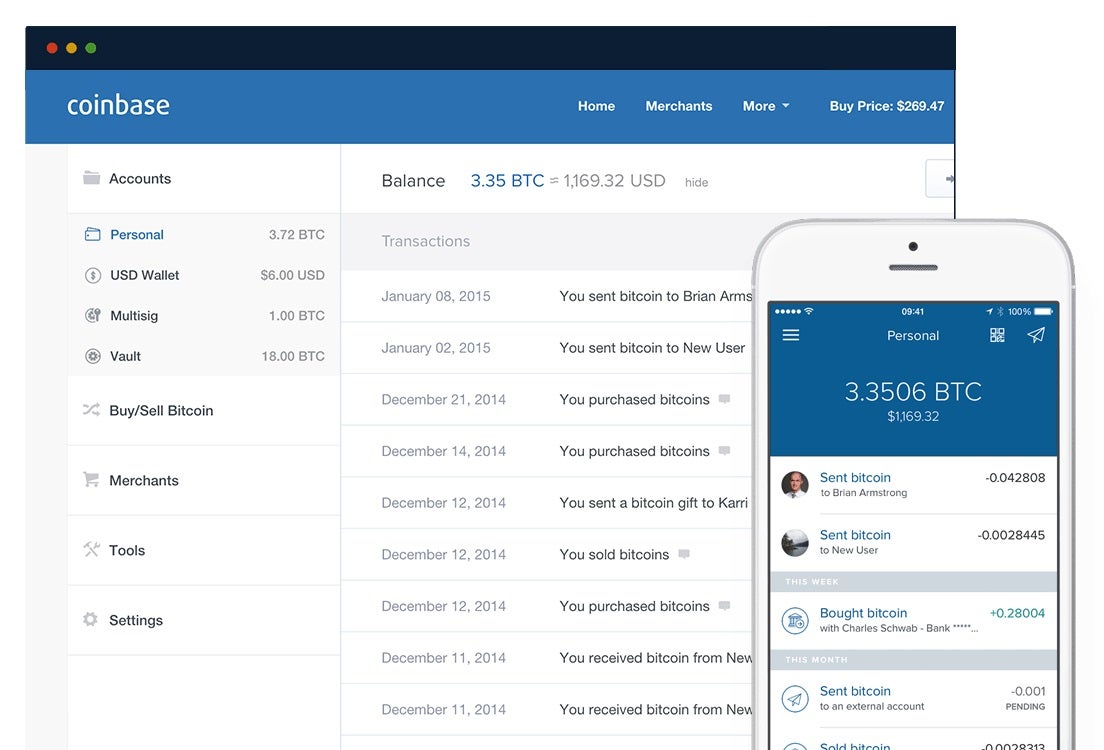

This is what your account page would look like if you were to sign up for a Bitcoin wallet on Coinbase. As you see, it looks kind of like the online banking software that most traditional commercial banks use for their customers:

Use Regular Money to Buy Bitcoin

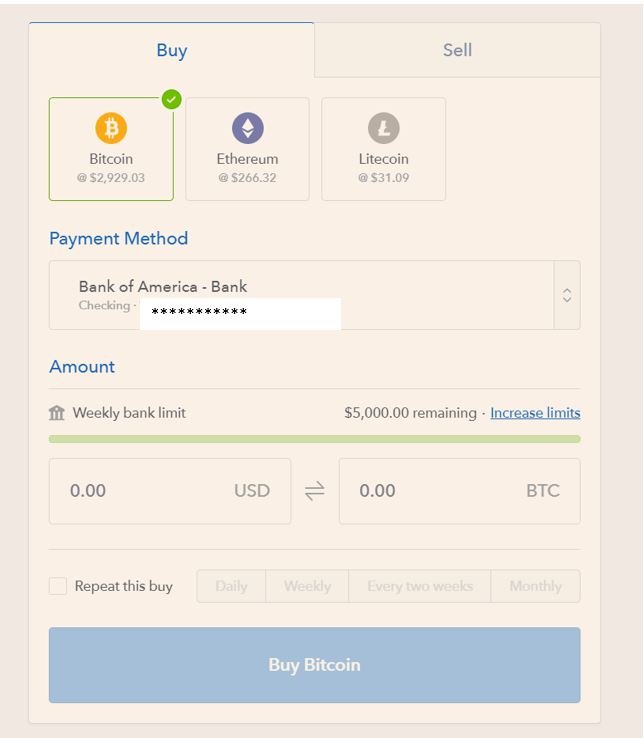

Once you have a Bitcoin wallet, you use a traditional payment method such as credit card, bank transfer (ACH), or debit card to buy Bitcoins on a Bitcoin exchange (example: Coinbase). The Bitcoins are then transferred to your wallet. The availability of the above payment methods is subject to the area of jurisdiction and exchange chosen. Here is a screenshot of the Bitcoin interface showing how to buy and sell not just Bitcoin but also Ethereum and Litecoin, which are other popular virtual currencies. As you see, it’s as straightforward as clicking on the “Buy” tab if you want to buy, and “Sell” tab if you want to sell. You select which currency you are buying/selling and which payment method (your bank account or credit card) you want to use.

Remember that “Bitcoin exchange” and “Bitcoin wallet” need not be the same. Bitcoin exchanges are kind of like forex exchanges – places where you can trade Bitcoin for a fiat currency, say, BTC for USD and vice versa (in U.S. for example). While exchanges offer wallet capabilities to users, it’s not their primary business. Since wallets need to be kept safe and secure, exchanges do not encourage storing of Bitcoins for higher amounts or long periods of time. Hence, it is best to transfer your Bitcoins to a secure wallet. Security must be your top priority while opting for a Bitcoin wallet; always opt for the one with multi-signature facility.

There are many well-established exchanges that act as a one-stop solution by offering high security standards and reporting. Due diligence must be exercised while choosing a Bitcoin exchange or wallet.

A Bitcoin Wallet is for Your Private Key, Not for Storing Bitcoin

The common assumption that Bitcoins are stored in a wallet is technically incorrect. Bitcoins are not stored anywhere. Bitcoin balances are kept using public and private “keys,” which are long strings of numbers and letters linked through the mathematical encryption algorithm that was used to create them. The public key (comparable to a bank account number or IBAN) serves as the address published to the world, and to which others may send Bitcoins.

The private key (comparable to an ATM PIN) is meant to be a guarded secret, and only used to authorize Bitcoin transmissions. Thus, it’s the “private key” that is kept in a Bitcoin wallet. Some safeguards for a Bitcoin wallet include: encrypting the wallet with a strong password and choosing the cold storage option, i.e. storing it offline. In the case of Coinbase, they offer a secure “multisig vault” to host your keys, which you can sign up for.

As a user, you are free to use those Bitcoins using the “private key” to buy a commodity, or make a payment for a service, or send money to a friend or family. These Bitcoins are sent using the “address” of the recipient. Selling Bitcoins on the exchange will earn you its selling amount in the local currency, which can be withdrawn by you.

Although Bitcoin is homogenous (the same everywhere in the world), its price varies across countries and even exchanges within the same country, giving a rise to arbitrage opportunities. The Bitcoin price in South Korea has been trading at a 35% premium while in India it has been at a 20-25% premium. The demand and supply conditions result in some aberrations in its price.

The number of places where Bitcoins can be spent is increasing rapidly and includes some big retail players as well as many small businesses and retailers. The increased acceptance is boosting its footprint across the globe and is helping it secure an official recognition as a mode of payment. Japan has recently accepted Bitcoin as a payment mode.

The Bottom Line

The changing regulatory stance, increasing adoption and acceptance, investments in Bitcoin start-ups and products being launched around it have cumulatively raised the confidence in Bitcoin. However, it’s still in a nascent stage and thus one must be aware of the price volatility issues, taxation aspect and legality angle before buying Bitcoins.

Find Related Articles on How to Solve Basic Problems and Life Hacks